Specialist Advice: Bagley Risk Management Strategies

How Animals Risk Defense (LRP) Insurance Coverage Can Secure Your Animals Investment

In the realm of animals investments, mitigating threats is vital to guaranteeing financial security and growth. Livestock Risk Protection (LRP) insurance stands as a trustworthy guard against the unpredictable nature of the marketplace, supplying a critical technique to securing your possessions. By delving into the intricacies of LRP insurance policy and its complex benefits, livestock manufacturers can fortify their financial investments with a layer of protection that goes beyond market changes. As we explore the realm of LRP insurance policy, its duty in safeguarding livestock investments ends up being significantly noticeable, guaranteeing a path in the direction of lasting financial resilience in an unstable industry.

Understanding Livestock Danger Protection (LRP) Insurance

Comprehending Animals Threat Protection (LRP) Insurance is crucial for animals producers looking to minimize monetary risks related to cost fluctuations. LRP is a government subsidized insurance item developed to protect manufacturers against a decrease in market value. By providing insurance coverage for market value decreases, LRP helps manufacturers lock in a flooring cost for their animals, guaranteeing a minimal level of earnings despite market variations.

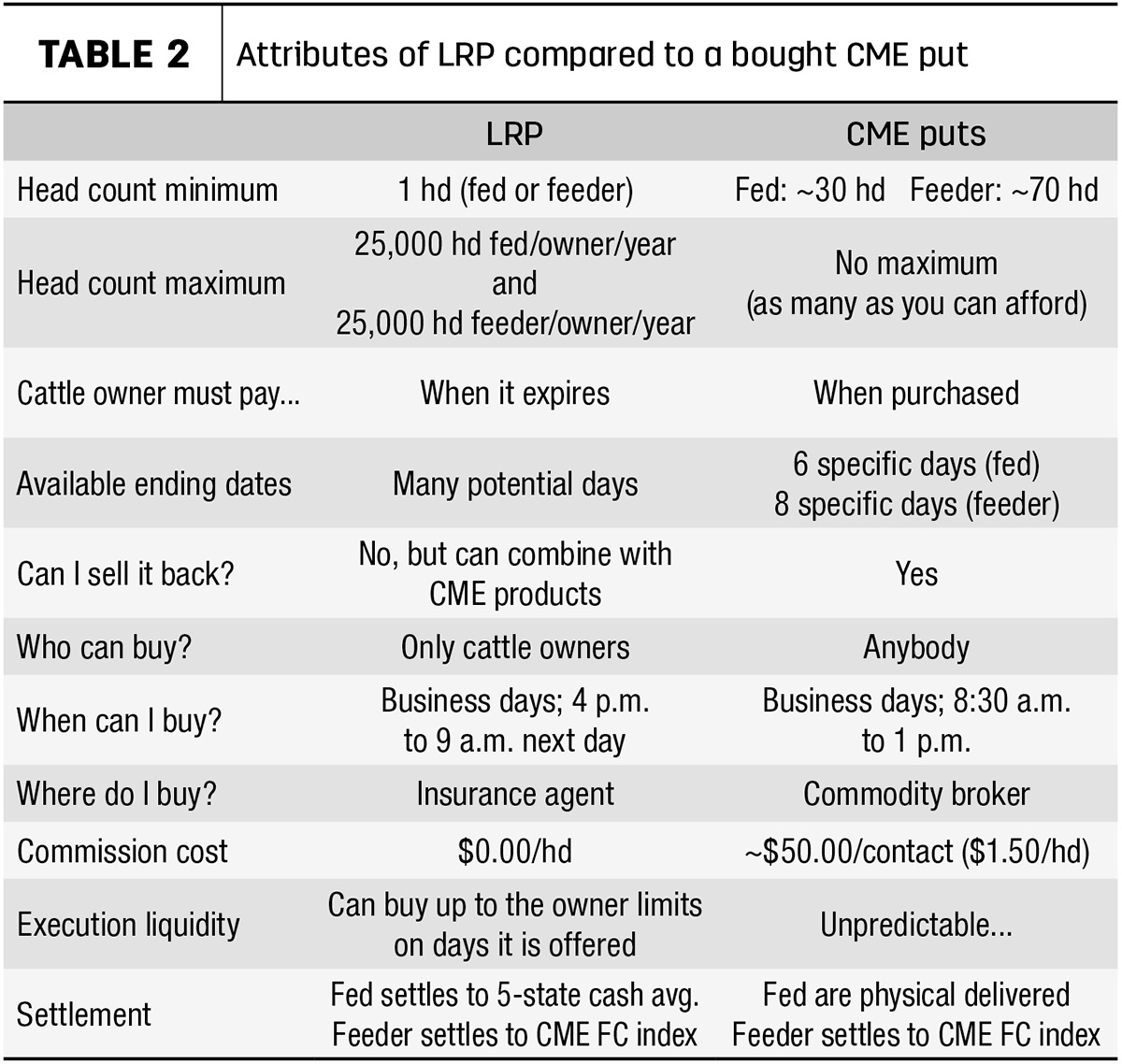

One key facet of LRP is its adaptability, allowing manufacturers to customize protection degrees and policy sizes to match their particular demands. Producers can pick the number of head, weight variety, insurance coverage price, and insurance coverage period that line up with their production objectives and risk resistance. Understanding these personalized options is crucial for manufacturers to efficiently handle their price threat exposure.

Additionally, LRP is readily available for numerous livestock types, consisting of livestock, swine, and lamb, making it a versatile threat management device for livestock producers throughout different fields. Bagley Risk Management. By acquainting themselves with the complexities of LRP, manufacturers can make educated choices to safeguard their investments and guarantee economic security when faced with market uncertainties

Benefits of LRP Insurance for Livestock Producers

Animals producers leveraging Animals Danger Defense (LRP) Insurance obtain a strategic advantage in shielding their financial investments from cost volatility and safeguarding a secure economic footing among market unpredictabilities. By establishing a floor on the price of their livestock, producers can mitigate the threat of substantial financial losses in the occasion of market slumps.

Additionally, LRP Insurance policy provides producers with tranquility of mind. Overall, the advantages of LRP Insurance coverage for animals producers are substantial, using a valuable tool for managing risk and making sure monetary safety in an uncertain market setting.

How LRP Insurance Mitigates Market Risks

Mitigating market risks, Animals Threat Security (LRP) Insurance provides livestock producers with a trustworthy guard against cost volatility and financial unpredictabilities. By using protection against unexpected price decreases, LRP Insurance coverage assists manufacturers protect their investments and keep economic stability in the face of market changes. This type of insurance allows animals producers to secure a cost for their animals at the start of the plan period, guaranteeing a minimum cost level despite market modifications.

Actions to Safeguard Your Animals Financial Investment With LRP

In the realm of agricultural danger administration, applying Animals Danger Security (LRP) Insurance involves a tactical process to safeguard financial investments versus market variations and unpredictabilities. To secure your livestock financial investment properly with LRP, the very first step is to evaluate the particular dangers your procedure deals with, such as rate volatility or unanticipated weather occasions. Recognizing these threats allows you visite site to figure out the insurance coverage level needed to safeguard your investment appropriately. Next off, it is crucial to study and select a reputable insurance coverage provider that supplies LRP plans customized to your livestock and business demands. Thoroughly review the plan terms, problems, and insurance coverage limitations to ensure they line up with your threat management objectives as soon as you have picked a provider. Additionally, routinely keeping track of market patterns and readjusting your protection as needed can assist optimize your protection against prospective losses. By complying with these steps vigilantly, you can improve the safety and security of your livestock financial investment and navigate market uncertainties with confidence.

Long-Term Financial Safety And Security With LRP Insurance Policy

Making certain enduring monetary stability via the use of Livestock Threat Protection (LRP) Insurance coverage is a sensible long-lasting method for farming manufacturers. By including LRP Insurance into their risk management strategies, farmers can guard their livestock financial investments versus unpredicted market variations and unfavorable events that might jeopardize their financial address well-being in time.

One trick benefit of LRP Insurance policy for long-lasting monetary safety is the comfort it offers. With a reliable insurance plan in place, farmers can mitigate the economic risks related to unstable market conditions and unanticipated losses as a result of factors such as disease outbreaks or natural calamities - Bagley Risk Management. This security enables manufacturers to concentrate on the day-to-day procedures of their livestock company without constant stress over potential economic obstacles

In Addition, LRP Insurance coverage gives an organized approach to taking care of danger over the long-term. By establishing particular insurance coverage levels and picking ideal recommendation durations, farmers can tailor their insurance intends to align with their financial objectives and take the chance of resistance, ensuring a lasting and safe and secure future for their livestock operations. To conclude, buying LRP Insurance policy is an aggressive method for agricultural producers to attain enduring monetary security and secure their incomes.

Conclusion

In conclusion, Animals Risk Defense (LRP) Insurance policy is a valuable tool for livestock manufacturers to minimize market threats and secure their financial investments. By recognizing the benefits of LRP insurance policy and taking actions to apply it, producers can accomplish long-lasting financial security for their procedures. LRP insurance provides a security web against cost fluctuations and guarantees a level of security in an unpredictable market setting. It view publisher site is a smart option for safeguarding animals investments.